Rotary Joint HSN Codes

Introduction

In the intricate web of international trade, Harmonized System Nomenclature (HSN) codes serve as the universal language for classifying goods. I’ve noticed a growing interest in the query “rotary joint HSN codes,” indicating that many businesses and professionals involved in importing or exporting rotary joints seek clarity on this crucial aspect.

In this blog, we’ll embark on a detailed exploration of HSN codes specifically related to rotary joints, understanding their significance, how to classify rotary joints accurately, and the implications for international trade. By the end, you’ll have a solid grasp of rotary joint HSN codes and how to optimize your content to rank well in search engines for this topic.

What are HSN Codes?

Before delving into rotary joint HSN codes, it’s essential to understand what HSN codes are. The Harmonized System Nomenclature is a standardized international system developed and maintained by the World Customs Organization (WCO). It assigns a unique six-digit code to every type of product traded globally, enabling customs authorities, businesses, and traders to identify and classify goods consistently.

These codes form the basis for various aspects of international trade, including:

Tariff Classification:

Determining the applicable customs duties and taxes when importing or exporting goods. Different HSN codes are associated with different tariff rates, which can significantly impact the cost of goods.

Trade Statistics:

Governments and international organizations use HSN codes to collect and analyze trade data. This information helps in understanding trade trends, monitoring economic growth, and making informed policy decisions.

Regulatory Compliance:

Ensuring that goods comply with relevant regulations, such as safety standards, environmental requirements, and import/export restrictions. Each HSN-classified product may have specific regulatory guidelines associated with it.

Why are HSN Codes Important for Rotary Joints?

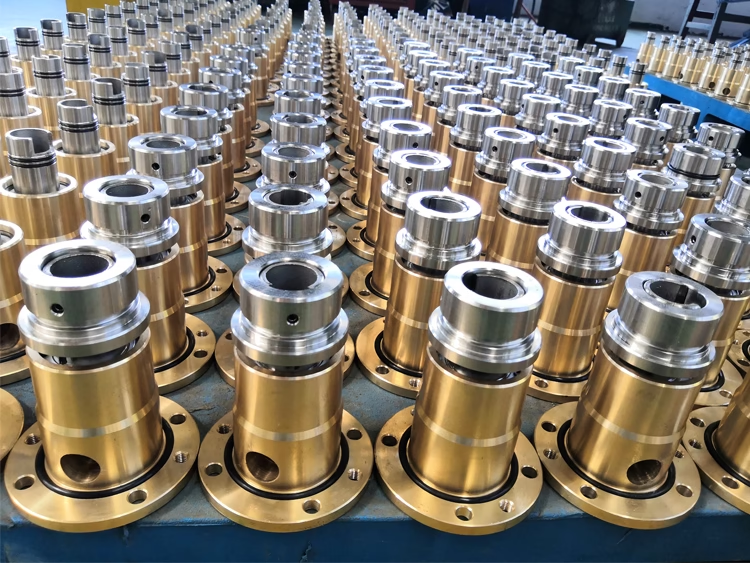

Rotary joints are widely used in various industries, from manufacturing and oil & gas to food processing and power generation. When it comes to the international trade of rotary joints, accurate HSN code classification is of utmost importance for several reasons:

Cost Management

The HSN code assigned to a rotary joint directly influences the customs duties and taxes imposed on it during import or export. Incorrect classification can lead to either overpaying or underpaying these charges. For example, if a high-precision industrial rotary joint is misclassified under a code meant for simpler, lower-value joints, the importer may face penalties and additional charges when the error is detected. On the other hand, over – classifying can result in unnecessary costs, eating into profit margins.

Smooth Customs Clearance

Customs authorities rely on HSN codes to process import and export shipments efficiently. A correctly classified rotary joint with the appropriate HSN code will experience fewer delays and inspections at the border. This not only saves time but also reduces the administrative burden on businesses. Conversely, incorrect HSN code assignment can trigger additional scrutiny, leading to shipment hold-ups and potential fines.

Trade Data Accuracy

Accurate HSN code classification of rotary joints contributes to reliable trade data collection. Governments and market researchers use this data to analyze industry trends, such as the growth rate of rotary joint imports and exports, the market share of different regions, and emerging demand patterns. Incorrect codes can skew this data, leading to inaccurate market insights.

Classifying Rotary Joints under HSN Codes

Classifying rotary joints under HSN codes can be a complex task, as it depends on several factors. Here’s a step – by – step approach to help you navigate the process:

Understand the HSN Structure

The HSN system is hierarchical, with codes ranging from broad categories to specific product descriptions. The first two digits of an HSN code represent a chapter, the next two digits denote a heading, and the final two digits are sub – subheadings. For example, in the code 8484.20, “84” is the chapter number, “8484” is the heading, and “8484.20” is the sub – heading. Familiarizing yourself with the structure helps in identifying the relevant chapter and heading for rotary joints.

While the full HS code spans 6 digits, many countries extend it to 8-10 digits for granular control. Let’s break down the structure using India’s HSN framework (common in South Asia):

First 2 digits (Chapter): Broad category (e.g., 84 = Machinery/Mechanical Appliances)

Next 2 digits (Heading): Subcategory (e.g., 8481 = Taps, Cocks, Valves, and Similar Appliances)

Next 2 digits (Subheading): Specific product type (e.g., 8481.80 = Other Valves)

Additional digits (Country-specific): Material, design, or end-use modifiers

Example:

Rotary Joint (Stainless Steel, Hydraulic Use):

India: 8481 80 90 (Valves for pipes/tanks, other materials)

EU: 8481 80 81 (Valves for hydraulic/pneumatic systems)

Identify the Key Characteristics of the Rotary Joint

To classify a rotary joint accurately, you need to consider its key characteristics:

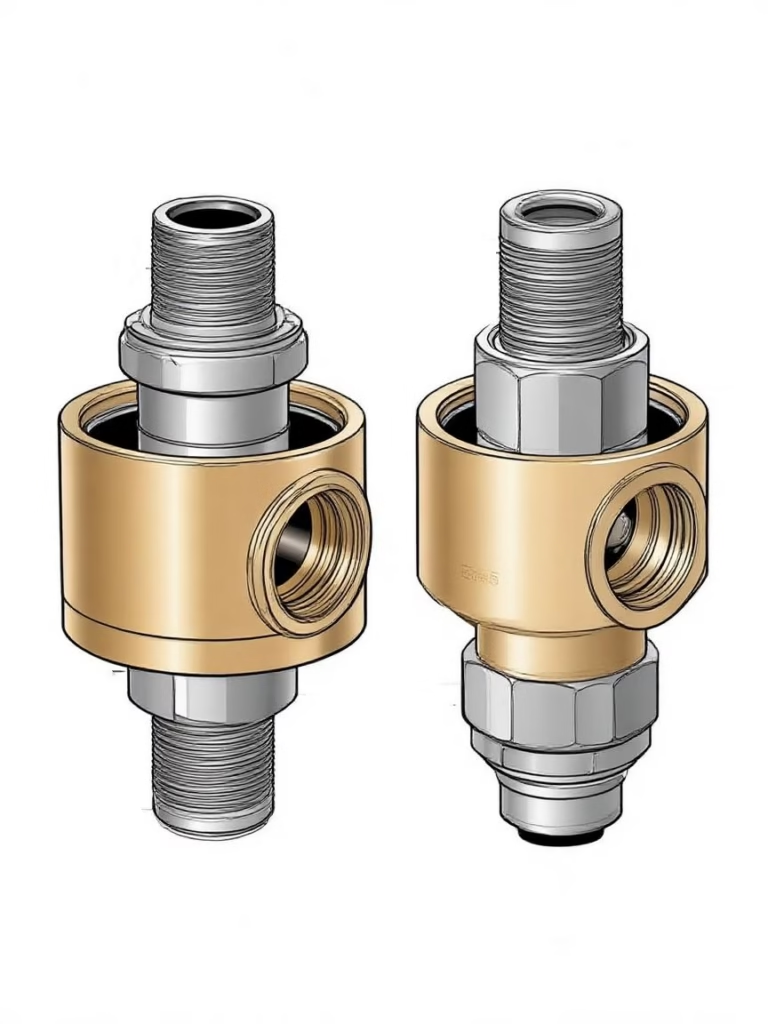

Type of Fluid Handled:

Whether it’s designed for water, steam, hydraulic oil, chemicals, or other fluids. Different fluids may affect the material and design of the rotary joint, influencing its classification.

Application Industry:

The industry in which the rotary joint is primarily used, such as manufacturing, oil & gas, or food processing. Some HSN sub – sub-sub-sub-subheadings are specific to certain industries.

Design and Functionality:

This includes factors like the number of passages (single-passage or multi-passage), operating pressure and temperature range, and the presence of special features like self-lubrication or high-speed compatibility.

Refer to the HSN Explanatory Notes

The WCO provides detailed Explanatory Notes for each HSN code. These notes offer in-depth explanations of the products covered under each heading and subheading, along with examples and guidelines for classification. When classifying a rotary joint, carefully study the relevant Explanatory Notes to ensure you make the correct choice. For instance, the notes may clarify whether a particular type of rotary joint with specific features falls under a general machinery parts category or a more specialized industrial equipment category.

Consult with Customs Experts or Brokers

If you’re still unsure about the classification of a rotary joint, it’s advisable to consult with customs experts or professional customs brokers. These individuals have in-depth knowledge of HSN codes and can provide accurate advice based on their experience. They can also help you navigate any complex scenarios, such as when a rotary joint has unique or hybrid features that make classification challenging.

Common HSN Codes for Rotary Joints

While the exact HSN code for a rotary joint depends on its specific characteristics, here are some common codes that rotary joints may fall under:

1: Analyze Product Specifications

Material:

Stainless steel (HSN: 7307), Brass (7412), Plastic (3917)

Pressure Rating:

High-pressure joints may fall under specialized headings.

Connection Type:

Flanged, threaded, or welded ends affect classification.

Temperature Resistance:

High-temperature joints (e.g., for kilns) might require distinct codes.

Pro Tip:

Document BOMs (Bill of Materials) and engineering drawings to justify your code during audits.

2: Map to HS Chapter 84/85

Most rotary joints fall under:

Chapter 84: Industrial machinery (e.g., 8481 for valves)

Chapter 85: Electrical machinery (if motorized joints)

Avoid this pitfall: Do not classify rotary joints as generic “machine parts” (HS 8409) unless they’re exclusively for engines.

Chapter 84: Nuclear Reactors, Boilers, Machinery, and Mechanical Appliances

Many rotary joints are classified under this chapter, as they are mechanical components used in various machinery and appliances.

Heading 8484:

Gaskets and similar joints of any material other than vulcanized rubber, fitted with or without reinforcing. Some simple rotary joints with basic sealing elements may be classified here if they primarily serve as joints in mechanical systems. However, this heading is more commonly associated with static gaskets, and rotary joints are less likely to be correctly classified under this heading unless they have very basic designs and functions similar to static gaskets.

Heading 8487:

Parts of machines and mechanical appliances, not specified or included elsewhere. This is a residual category that can cover rotary joints when they don’t fit precisely into more specific headings. Rotary joints with unique features or those used in non-standard applications may end up being classified here. For example, a custom – made rotary joint designed for a one – of – a – kind industrial machine that doesn’t match the descriptions of other more defined headings could fall under 8487.

Chapter 85: Electrical Machinery and Equipment and Parts Thereof

In some cases, if a rotary joint has electrical components, such as sensors or heating elements integrated into its design, it may be classified under Chapter 85. However, this is relatively rare, and most rotary joints are mechanical and fall under Chapter 84.

Case Studies of Rotary Joint HSN Code Classification

Case 1: Standard Industrial Rotary Joint for Hydraulic Systems

A company manufactures a standard single-passage rotary joint used in hydraulic systems in manufacturing plants. It has a stainless-steel housing, a mechanical seal, and can handle medium-pressure hydraulic oil. After analyzing its characteristics and referring to the HSN Explanatory Notes, it is determined that this rotary joint falls under sub – heading 8487.90. This is because it is a part of mechanical appliances (hydraulic systems) and doesn’t fit into more specific headings related to hydraulic components or other machinery parts.

Case 2: High-Temperature Rotary Joint for Steam Applications

Another company produces a high-temperature, multi-passage rotary joint specifically designed for steam applications in power plants. It has special heat-resistant materials, advanced sealing technology, and is engineered to withstand high pressures and temperatures. After careful consideration, this rotary joint is classified under subheading 8419.90. The Explanatory Notes indicate that equipment and parts for handling steam at high temperatures, which don’t fall under more specific steam-related headings, can be classified here. This example shows how the application and specialized features of a rotary joint can lead to a specific HSN code assignment.

Case 3: Overpayment of Duties

A U.S. manufacturer exported aluminum rotary joints to Germany. They incorrectly used HS 7616 (aluminum articles) instead of 8481 (valves). Result? A 3.7% duty instead of 0% under the EU-US Free Trade Agreement, costing $12,000 annually.

Case 4: Customs Seizure

An Indian importer declared stainless steel rotary joints as HS 7324 (sanitary ware). Customs rejected the code, citing HS 8481 as mandatory for industrial valves. The shipment was detained for 45 days until the correct documentation was submitted.

FAQs About Rotary Joint HSN Codes

Q1: Why is the correct HSN code critical for rotary joint exports/imports?

The HSN code directly impacts customs duties, trade agreement eligibility, and compliance. An incorrect code can lead to overpaid duties (e.g., a U.S. exporter lost $12,000 annually by misclassifying aluminum joints) or shipment delays (like an Indian importer facing 45-day detention). Governments use HSN codes to enforce anti-dumping measures—China’s duties on EU joints highlight this risk. Accurate coding ensures seamless cross-border trade and avoids legal penalties.

Q2: How do I determine the right HSN code for my rotary joint?

Follow this 5-step process:

Analyze specs: Material, pressure rating, and design (e.g., stainless steel vs. plastic).

Map to HS chapters: Most joints fall under Chapter 84 (machinery) or 85 (electrical).

Check explanatory notes: Confirm if your joint includes sensors (HS 9026) or medical-grade parts.

Use country-specific tools: India’s DGFT portal or the EU’s TARIC database.

Validate with experts: Customs brokers can prevent errors like misapplying “machine parts” codes.

Q3: What happens if I use the wrong HSN code?

Risks include:

Financial losses: Overpaying duties (e.g., 3.7% extra for EU joints) or anti-dumping penalties.

Operational delays: Shipments detained until corrections are made.

Legal issues: Audits and fines for non-compliance.

Missed trade benefits: Free Trade Agreements (FTAs) like AANZFTA require precise codes for 0% duties.

Conclusion

Understanding rotary joint HSN codes is crucial for businesses involved in the international trade of these essential mechanical components. Accurate classification impacts cost management, customs clearance, and trade data accuracy. By following the proper classification process, referring to HSN Explanatory Notes, and seeking expert advice when needed, you can ensure that your rotary joints are assigned the correct HSN codes. If you have any further questions or need more in-depth analysis of specific rotary joint HSN code scenarios, feel free to leave a comment below.